Another bad one, reversing last month’s suspect move up:

Chicago PMI![]()

Highlights

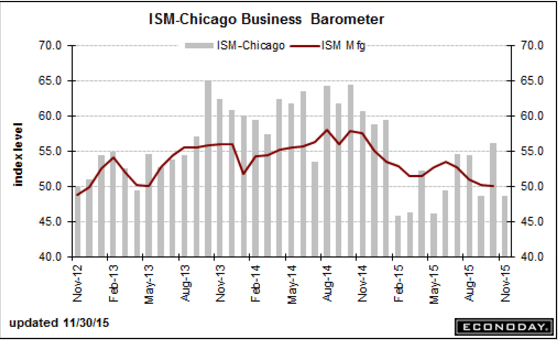

Volatility is what to expect from the Chicago PMI which, at 48.7, is back in contraction in November after surging into strong expansion at 56.2 in October. Up and down and up and down is the pattern with prior readings at 48.7 in September (the same as November) and 54.4 in August.

New orders are down sharply and are back in contraction while backlog orders are in a 10th month of contraction. Production soared nearly 20 points in October but reversed most of the gain in November. Despite November’s weakness, employment are up slightly. Prices paid is in contraction for a fourth straight month.

Though this report points to November weakness for the whole of the Chicago economy, the volatility of the report should limit its impact on the month’s outlook.

Along with the ISM, it’s decelerated with the collapse in oil related capital expenditures, and nothing yet has come along to fill that spending gap (apart from building unsold inventory):

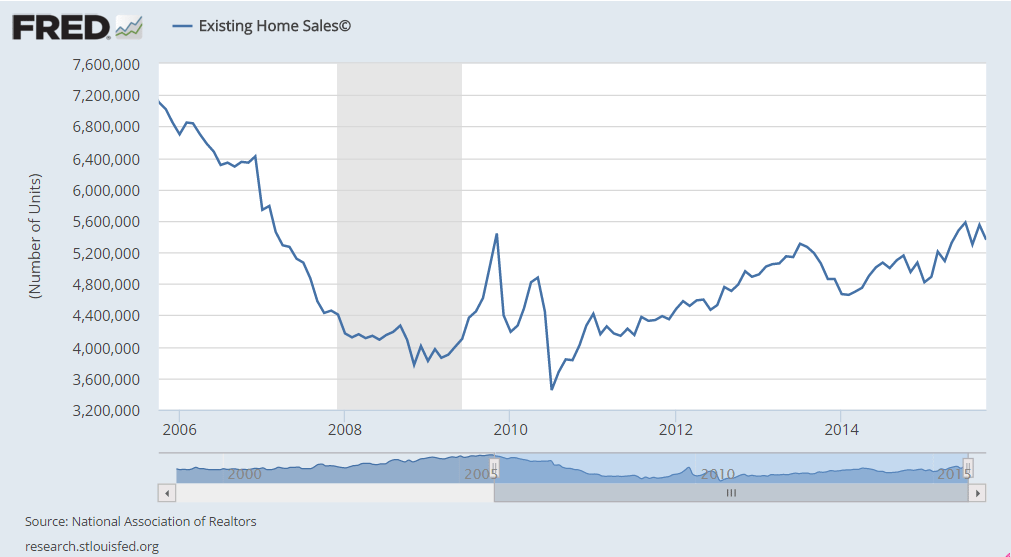

More bad, and it’s not like mortgage rates aren’t low:

Pending Home Sales Index

Highlights

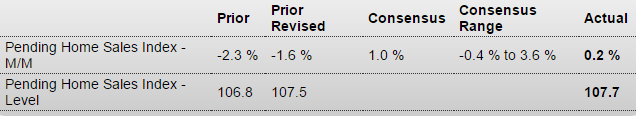

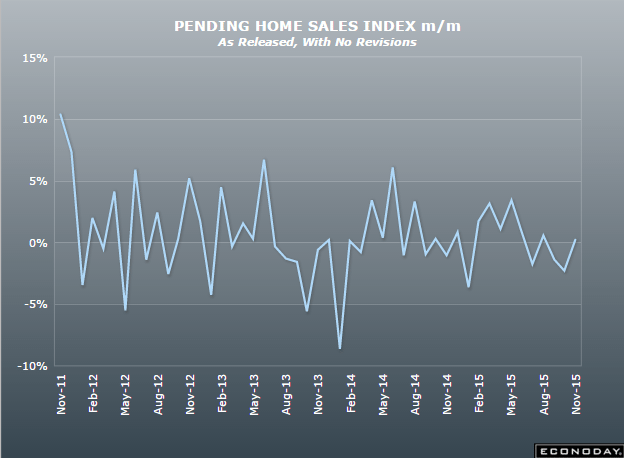

Sales of existing homes have been soft and are not likely to pick up in the next few months based on October’s pending sales index which is up only 0.2 percent. Year-on-year, the index is up 3.9 percent which matches the rate of gain for final sales during October. Flatness, unfortunately, is the theme.

The Northeast did the best in October, up 4.5 percent for a year-on-year plus 6.8 percent. The West is next with pending sales up 1.7 percent for a year-on-year gain of 10.4 percent. Bringing up the rear are the Midwest, down 1.0 percent on the month for a year-on-year plus 3.3 percent, and the largest region which is the South, down 1.7 percent in October for the only negative year-on-year reading of minus 0.3 percent.

The National Association of Realtors cites low supply of available homes as a negative for sales and warns that prices in some markets are rising too fast, especially for first-time buyers. The association cites strength in the Northeast as an example, a region where price appreciation is lower and supply greater.

The new home market isn’t doing that much better than existing homes, with sales up 4.9 percent year-on-year in the latest available data. Watch for construction spending on tomorrow’s calendar, one aspect of the housing market that has been showing solid strength.

And in sync with last week’s existing home sales report also showing flatness at low levels:

Not as bad as expected but still in contraction mode:

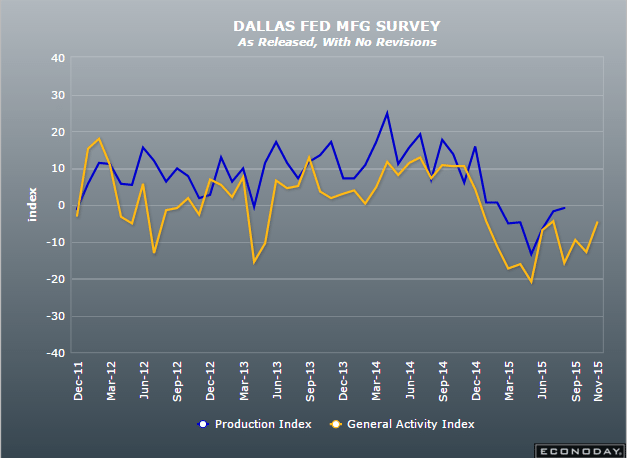

Dallas Fed Mfg Survey![]()

Highlights

The Dallas Fed’s general activity index is in contraction for an 11th consecutive month, at minus 4.9 for November which is, however, improved from October’s minus 12.7. The Econoday consensus was calling for an 11.0 point decline.

Order readings are also negative, at minus 1.6 for new orders, which is a 6 point improvement, but at minus 7.3 for the growth rate of new orders which is little changed from October and in the negative column for the 13th month in a row.

On the plus side is a second straight increase for production, up 4 tenths to 5.2. And readings on the business outlook are steady to higher.

But price data in the report are pushing further into negative ground with finished goods prices at minus 12.1 for an 11th straight negative reading, underscoring the deflationary effects of low energy prices on the Texas economy.

This report rounds out what is a flat to negative run of regional indications for the nation’s manufacturing sector during November, a sector that continues to be hurt by weak export demand and low prices.

The post Chicago PMI, Pending home sales, Dallas Fed appeared first on The Center of the Universe.