The stock market is happy on the false assumption that bad news means lower rates from the Fed which is good for profits, but that’s another story…

Income and spending weak, and prices soft as the Fed continues to fail on at least that part of its mandate:

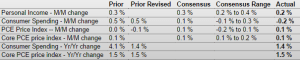

Personal Income and Outlays

Highlights

Personal income continues a modest uptrend but spending slipped on volatile auto sales and lower gasoline prices. Personal income advanced 0.2 percent in September, following a 0.3 percent gain in August. Analysts projected a 0.3 percent gain for September. The wages & salaries component increased 0.2 percent, following a 0.5 percent boost the prior month. Averaging the wage gains leaves consumer basic income moderately healthy.

Analysts botched their forecast for spending for September-and for no apparent reason. Personal spending declined 0.2 percent after jumping 0.5 percent in August. The latest figure came in below market expectations for a 0.1 percent rise. Weakness was in the durables component which fell 2.0 percent after a 2.1 percent jump in August, reflecting swings in auto sales. Lower gasoline prices pulled down on nondurables. Nondurables spending declined 0.3 percent after falling 0.4 percent in August. Services firmed 0.2 percent, following a 0.5 percent spike in August.

PCE inflation remains soft. The September figure matched expectations for a 0.1 percent increase and followed a dip of 0.1 percent in August. Core PCE inflation rose 0.1 percent in September, following a gain of 0.1 percent in August and equaling expectations.

On a year-ago basis, headline PCE inflation held steady at 1.4 percent in September. Year-ago core inflation was 1.5 percent in both September and August. The Fed doves will not be in a rush to boost policy rates early next year.

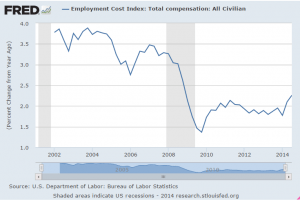

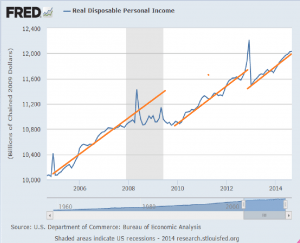

Note how after tax cpi adjusted income- purchasing power- keeps ratcheting down:

And wonder why you don’t hear much about this?

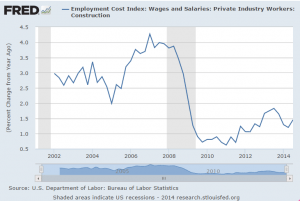

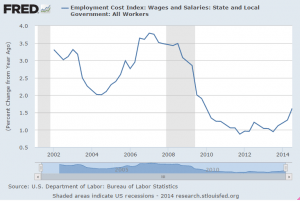

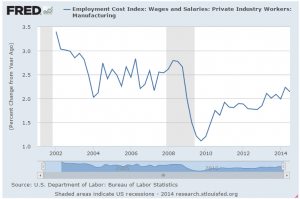

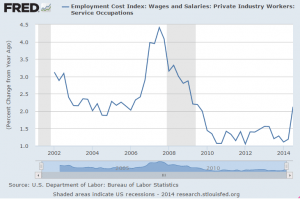

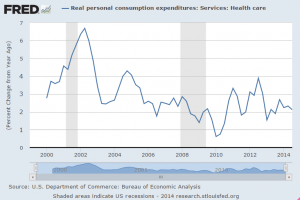

Working its way higher, but still very low, particularly in light of productivity increases. And with profit margins at a new record high of 13%, almost double the norm, there’s

plenty of room for wages to increase before pressuring prices.