The Dow Jones Industrial Average posted a 326-point (2.1%) plunge on Feb. 3, triggering a flood of stock market crash talk.

January wasn't any better - led by another triple-digit fall (318 points, 3.5%) on Jan. 24, the Dow suffered its worst January since 2009 and its worst month since May 2012, deflating 5.3%. (The S&P 500 slid 3.6%, also its worst monthly performance since May 2012, and the Nasdaq dropped 1.7%, its worst since October 2012.)

Three factors are making market-watchers fearful of a full-blown stock market crash:

The Dow climbed 27.36% in 2013.

An official market correction - defined as a decline of 10% or more - hasn't happened since 2011.

The VIX, Wall Street's volatility measure and "fear gauge," climbed 16.46% on Feb. 3 alone - and 56.27% between the New Year and that same day.

Note: Turn market volatility into profits by learning to trade the market's most powerful index. Here's how...

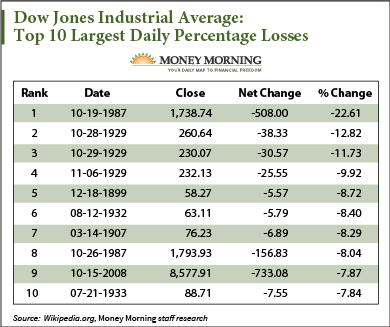

But 2014's one-day slips in the Dow are about half as big as the worst percentage drops in Dow history.

Here are the 10 largest one-day percentage plunges in Dow history.

The largest-ever percentage loss of 22.6% on Oct. 19, 1987, earned it the dark title "Black Monday."

Stock markets around the world came crashing down, beginning in Hong Kong, spreading its tendrils west to Europe, and finally finding U.S. markets. (Note that Australia and New Zealand call this day "Black Tuesday" because of the time zone difference.)

There are a few theories regarding the cause of Black Monday, but the most popular is program trading.

"Program trading" is a type of securities trading in which groups of 15 stocks or more are traded simultaneously based on preexisting factors via computer program. Investors use this method when they wish to trade a large number of stocks at the same time, or to take advantage of a window of price discrepancies between markets (arbitrage).

In the late 1980s, computer technology became more common, leading to a burst of program trading use on Wall Street. The public largely blamed program trading for blindly selling stocks as the market dropped, exacerbating the crash. Whether that was actually the case, or the sheer novelty of mass program trading caused a general distrust of it, is debatable. Some other theories on what caused Black Monday are overvaluation, illiquidity, and market psychology.

Oct. 26, 1987 - the Monday following Black Monday - marks the eighth biggest percentage drop. The value of all U.S. stocks fell $203 billion, an evaporation of wealth that, at the time, was only exceeded by the $503 billion drop a week earlier.

Traders noted further deterioration in market psychology. U.S. President Ronald Reagan began talks with congressional leaders to cut the federal budget deficit in hopes that such action would restore market confidence.

The second-largest daily percentage loss on the Dow is another "Black Monday," and it's followed by the third-largest drop on "Black Tuesday," on Oct. 28-29, 1929. The fourth-largest drop quickly followed on Nov. 6, 1929. Together, they combine for the "Wall Street Crash of 1929" - easily the most devastating stock market crash in U.S. history when taking the full extent and duration into consideration.

A speculative boom is to blame for this sad halt on the Roaring Twenties. An economic bubble formed on rising share prices that encouraged people to invest.

"We are reaping the natural fruit of the orgy of speculation in which millions of people have indulged," the president of Chase National Bank said at the time. "It was inevitable, because of the tremendous increase in the number of stockholders in recent years, that the number of sellers would be greater than ever when the boom ended and selling took the place of buying."

The sixth- and tenth-largest daily percentage losses in Dow history, on Aug. 12, 1932, and July 21, 1933, are both to do with volatility following the aftermath of the Wall Street Crash of 1929.

The fifth-largest daily percentage loss in Dow history occurred all the way back on Dec. 18, 1899. The New York Times published an article the following day titled, "Day of Panic and Financial Wrecks." It began:

"Much the worst panic that Wall Street has seen since the memorable crash of 1893... came upon the Street yesterday, and when the day was over market values had declined millions upon millions of dollars, men who but few hours before had counted their money by the thousands were ruined, and gloom was everywhere."

"Overspeculation in industrials" was blamed for the crash.

The seventh-largest percentage drop on the Dow was during the "Panic of 1907" on March 14, 1907, also known as the "1907 Bankers' Panic" or "Knickerbocker Crisis."

The New York Stock Exchange fell nearly 50% from its peak the previous year, sparking runs on banks and trust companies. Several banks and businesses were forced into bankruptcy, including New York City's third-largest trust, Knickerbocker Trust Company.

J.P. Morgan intervened, pledging enormous sums of his own money to shore up the banking system. He was able to convince other bankers to follow suit.

Morgan was celebrated briefly as a hero, but because few banks and trusts had survived, the remaining concentrated wealth caused worry. Soon after, the U.S. House of Representatives convened an investigation on a "money trust" - the de factomonopoly of Morgan and a few other bankers. Ultimately, in 1913 the "money trust" would be replaced by the U.S. Federal Reserve as the lender of last resort.

The ninth-largest percentage crash on Oct. 15, 2008, was also the second-largest single-day Dow point crash. It followed soon after the biggest ever single-day point crash on Sept. 29, 2008.

On that day, the U.S. House of Representatives rejected the government's $700 billion bank bailout plan. This Dow drop obliterated $1.2 trillion in market value. News that Wachovia (which was acquired by Wells Fargo in 2008) had to sell its banking assets to Citigroup (NYSE: C) the same day didn't help, nor did the collapse of a number of European banks.

Six days later, recession talk fueled further decline. A weak sales report, bleak forecasts from the U.S. Federal Reserve, and sober comments from Fed Chairman Ben Bernanke all contributed to the day's plummet.

Join the conversation on Twitter on market #volatility in 2014, and be sure to follow @MoneyMorning.

Volatility has certainly defined the markets in the early weeks of 2014. But rather than locking in losses on the sidelines, here's how to take advantage of the profits that the boom/bust crowd is leaving behind...

Related Articles:

- Wikipedia:

List of Largest Daily Changes in the Dow Jones Industrial Average - The Sydney Morning Herald:

Second Crash - The New York Times:

Day of Panic and Financial Wrecks: Securities Fall Many Points and Millions Are Lost, Failures Alarm Traders

The post Stock Market Crash History: The Dow's 10 Biggest One-Day Percentage Losses appeared first on Money Morning - Only the News You Can Profit From.